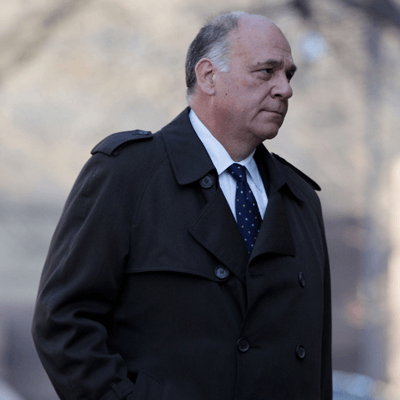

Thomas E. Zehnle has more than 30 years of experience in tax, white collar and civil litigation. He brings a broad perspective to handling such matters, having served as a defense lawyer, a federal prosecutor, and as the chief of a U.S. Department of Justice (DOJ) criminal enforcement section supervising tax and related financial fraud prosecutions across the United States. He maintains a diverse practice, representing corporations, partnerships, accounting firms, professional service providers and individuals who have been indicted or who are involved in grand jury investigations, federal regulatory actions and civil disputes.

Throughout his career, Mr. Zehnle has tried numerous cases to verdict and has successfully handled investigations involving allegations of tax evasion, Bank Secrecy Act (BSA) violations, accounting and securities fraud, money laundering, conspiracy, false claims and Foreign Agents Registration Act (FARA) violations. He regularly represents clients with respect to examinations of complex tax shelters and advises individuals, financial professionals and financial institutions regarding undisclosed foreign assets and accounts. Mr. Zehnle has substantial experience conducting internal investigations of potential corporate misconduct. He has also been selected by companies and approved by federal and state agencies as an independent monitor and examiner on numerous occasions, and has conducted examinations of publicly-traded and private companies pursuant to agreements mandated by the DOJ, the Securities and Exchange Commission (SEC) and state enforcement agencies.

Mr. Zehnle is the author of dozens of articles relating to tax, white collar, and civil litigation and he has been frequently published in legal journals and periodicals. He has been quoted often in media outlets such as The New York Times, The Washington Post, BusinessWeek, Bloomberg News and BNA. Mr. Zehnle is a regular lecturer, appearing at conferences and seminars sponsored by the American Bar Association, the National Association of Criminal Defense Lawyers, the Federal Bar Association, the DOJ, the Internal Revenue Service (IRS) and the Society of Trust and Estate Practitioners.

Bar Admissions

- District of Columbia

- Virginia

Court Admissions

- United States District Court for the District of Columbia

- United States District Court for the District of Maryland

- United States District Court for the Eastern District of Virginia

- United States Court of Appeals for the District of Columbia

- United States Court of Appeals for the Fourth Circuit

- United States Tax Court